Which qbo list would be used with the following transactions – The topic of which QBO list should be used with specific transactions is an intriguing one that delves into the intricacies of financial accounting. Understanding the purpose and functionality of each QBO list is paramount for accurate financial reporting and reliable financial statements.

This comprehensive guide will provide a detailed overview of the different types of QBO lists, the criteria for assigning transactions to each list, and the impact of QBO lists on financial reporting.

QBO Lists: Categorizing Transactions for Accurate Financial Reporting

QuickBooks Online (QBO) lists are essential tools for categorizing transactions in a way that supports accurate and reliable financial reporting. Understanding the different types of QBO lists and how to assign transactions to them is crucial for maintaining the integrity of financial data.

Identify QBO Lists for Specific Transactions

QBO lists are organized into categories that align with specific types of transactions. Common categories include:

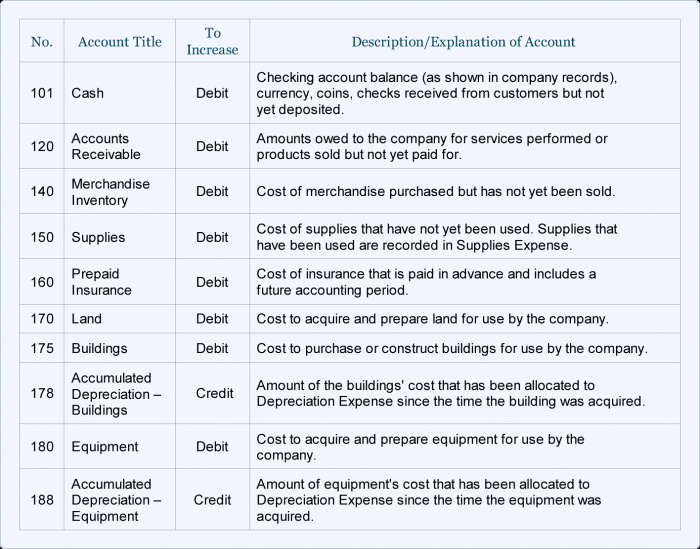

- Chart of Accounts:Tracks income and expense accounts.

- Customer List:Contains information about customers.

- Vendor List:Stores information about vendors.

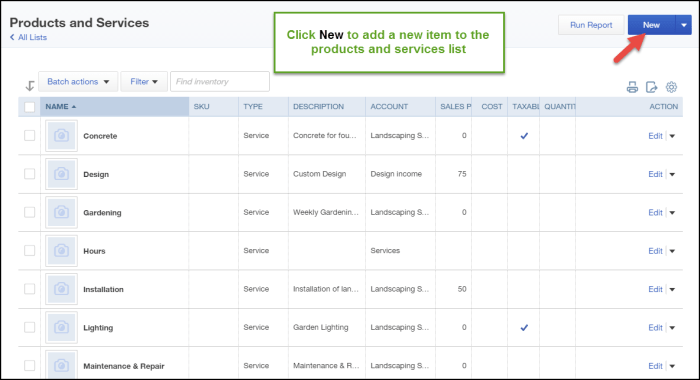

- Item List:Lists products and services offered.

- Class List:Used to track expenses and income by specific categories.

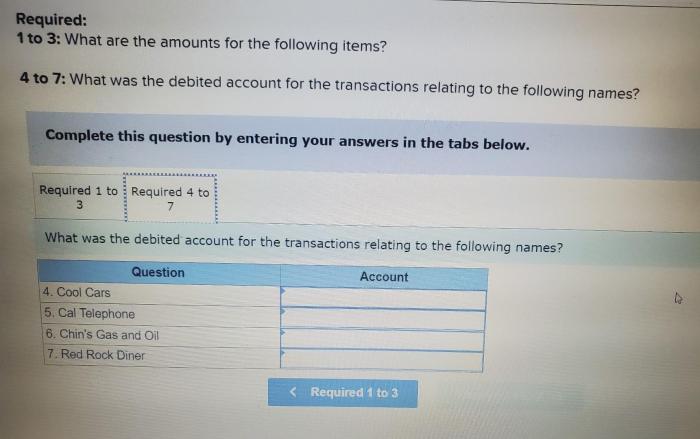

To assign transactions to the appropriate list, consider the following criteria:

- Nature of the transaction:What type of transaction is it (e.g., sale, purchase, expense)?

- Entity involved:Who is the customer, vendor, or employee involved in the transaction?

- Item or service:What product or service is being sold or purchased?

Types of QBO Lists, Which qbo list would be used with the following transactions

QBO offers a range of lists to accommodate different types of transactions:

- Static Lists:Remain unchanged once created (e.g., Chart of Accounts).

- Dynamic Lists:Automatically updated as new transactions are entered (e.g., Customer List).

- Custom Lists:Created by users to meet specific business needs (e.g., Class List).

Categorizing Transactions into QBO Lists

To categorize transactions accurately, follow these steps:

- Identify the nature of the transaction.

- Determine the entity involved.

- Select the appropriate list based on the transaction type.

- Assign the transaction to the specific list item (e.g., customer, vendor, account).

For transactions that fall under multiple categories, use a combination of lists. For example, a purchase of inventory from a vendor can be assigned to the Item List, Vendor List, and Expense Account in the Chart of Accounts.

Impact of QBO Lists on Financial Reporting

QBO lists play a vital role in financial reporting by:

- Ensuring accuracy:Categorizing transactions correctly prevents errors and ensures the integrity of financial data.

- Facilitating analysis:QBO lists allow users to easily analyze transactions by category, making it easier to identify trends and patterns.

- Generating reports:QBO lists provide the foundation for generating accurate financial reports, such as balance sheets and income statements.

Expert Answers: Which Qbo List Would Be Used With The Following Transactions

What are the different types of QBO lists?

QBO lists include customer lists, vendor lists, employee lists, item lists, and account lists.

How do I determine which QBO list to use for a specific transaction?

The type of transaction determines which QBO list to use. For example, customer transactions are assigned to the customer list, vendor transactions to the vendor list, and employee transactions to the employee list.

What is the impact of QBO lists on financial reporting?

QBO lists provide the basis for generating accurate financial reports. By categorizing transactions into specific lists, businesses can easily track and analyze financial data, ensuring the reliability of their financial statements.